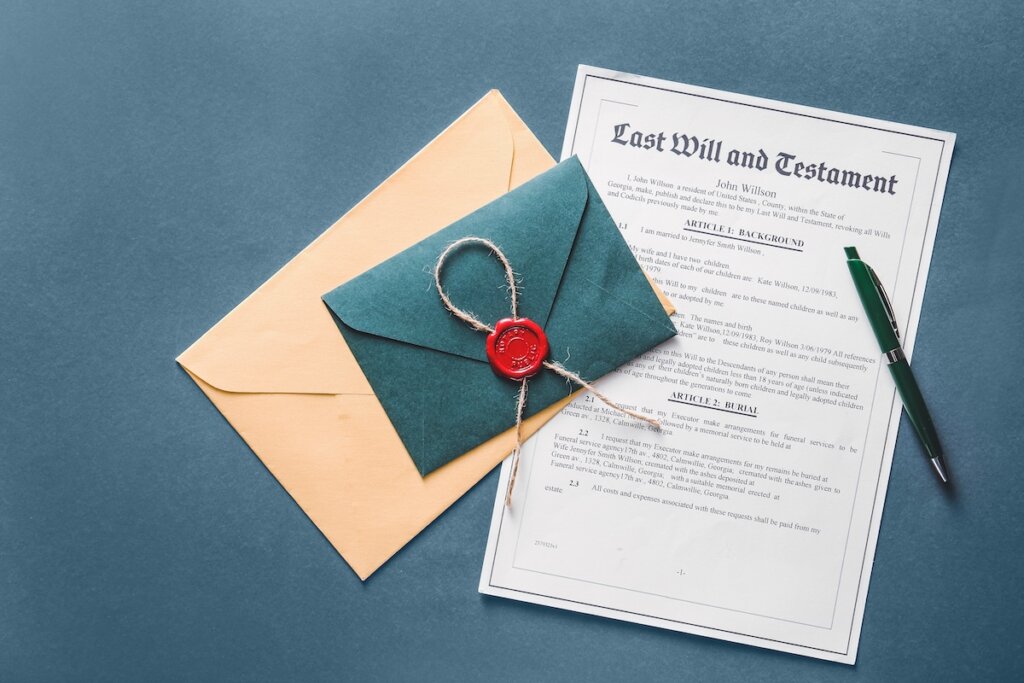

Inheriting a property can be emotionally challenging and financially burdensome. You may be faced with questions such as: Does the property require expensive upgrades and repairs? How much will you owe in taxes? Is there a will in place, or will you need to navigate the probate process?

So, what does it take for a homeowner to sell a newly inherited property? Are there specific steps that must be followed for this type of sale? This article will outline the process of selling an inherited property to help you maximize your potential profit.

How To Sell An Inherited Property in LA

You’ve received a property as an inheritance and are now wondering what to do next. In many states, this inherited property must go through probate. In Louisiana, this is referred to as Succession. Succession is a legal procedure where the court decides who legally owns the property. During this time, the court transfers the estate assets to the rightful heirs or beneficiaries. The duration of this process can vary significantly based on whether there’s a will and other factors in your state.

Handling succession in Louisiana involves several key steps to ensure a smooth process, such as determining the executor, working with lawyers and real estate agents, resolving debts, and cleaning and restoring the home.

Determine the Executor

Establishing an executor is usually straightforward for inherited properties with a will. The executor carries out the deceased’s wishes during probate, but assets cannot be sold until the court validates the will.

If the will is contested or nonexistent, the probate court appoints a non-family estate administrator to manage the estate. This administrator is responsible for fulfilling the deceased’s wishes, paying off debts, and distributing assets, including selling real estate to settle obligations like back taxes or mortgages.

Working with Lawyers and Real Estate Agents

The probate or succession process can be complicated, so working with an experienced lawyer is essential when selling an inherited home. After obtaining court approval to sell, it’s critical to partner with a real estate agent specializing in inherited properties. An agent with expertise in probate sales can help you find the right buyer and maximize your sale price. They can advise you on which repairs and upgrades are worth your investment, helping you avoid pitfalls that could result in a lower sale price or more extended time on the market.

At Abbott Price, we understand the challenges of being an unplanned property owner.

Whether you’re grappling with mortgage payments, taxes, insurance, maintenance, or just the emotional weight of it all, we’ve got you covered.

Resolve Any Debts

When you think of “inheritance,” do you envision a wealthy relative leaving you a mansion, or do you recognize the reality of managing a property with potential liens, back taxes, and an existing mortgage? Dealing with a loved one’s passing often means confronting their debts, including unpaid taxes and credit card bills. Any inherited assets must cover these debts before you see any value from the estate. A house can seem like a valuable asset but may also be a costly burden. An experienced estate advisor can help you navigate your options.

Clean & Restore the Home

After confirming ownership of the property, your next step is to decide whether to live in it, rent it out, or sell it. Inheriting a house from a loved one can often mean dealing with a property in poor condition due to years of neglect or a lack of upgrades, requiring extensive cleaning or renovation to make it market-ready.

At Abbott Price, we purchase properties “As-Is” with no repairs necessary.

You don’t even need to clean it out. We take care of that for you!

Contact Us today for your cash offer!

Contact us today and get a competitive cash offer for an inherited house, condo, or property. We buy homes in any condition, and we can also help with the convoluted process of selling a house in probate!

Frequently asked questions about selling an inherited property

Do all heirs have to agree to sell the property?

No, the heirs do not need to all agree to sell a house or property that has been inherited if a will or the probate court has already confirmed ownership. However, if there is no established ownership—such as in cases without a will or a court-appointed administrator—then all heirs must agree to proceed with the sale. This condition also applies to properties that the court has auctioned off to help settle the estate’s debts. If someone buys a house at auction and one or more heirs oppose the sale, the purchase will be put on hold until the disagreement is resolved and an agreement is reached.

How to Settle a Disagreement

When family members disagree about an estate, there are several ways to resolve the issues. The first step is to ensure that a trusted loved one has been designated as the executor. This person is responsible for fulfilling the wishes of the deceased as outlined in the will, which can help prevent conflicts regarding the management of the assets. If no executor has been appointed and the will is challenged, it may be beneficial to hire a mediator. A neutral third party can assist in resolving disputes and is often much more cost-effective than pursuing legal action in court over the estate.

Best Practices

What if the issue lies with the executors themselves? Disputes can arise when a family member is appointed as the executor or trustee of a will, leading to tension among other family members. If you find yourself in this situation, one option is for the appointed person to decline the role and select an independent fiduciary, such as an estate-planning attorney, to manage the will. Allowing a neutral party to take over can help prevent conflicts and provide everyone with the time and space needed to process their emotions, reducing the risk of long-lasting damage to family relationships.

How is an inherited property taxed when sold?

State and local governments in the United States collected over $5.3 billion in revenue from estate and inheritance taxes in 2020. That’s a lot of taxes! But with laws and regulations different from state to state, you’ll want to research and contact a lawyer with knowledge and experience in taxes and estate planning as you deal with a surprise inheritance or you’re writing your own will.

State Tax Laws

Each state has different laws regarding inheritances. For the sale of an inherited property, states may take an estate tax, an inheritance tax, and a capital gains tax on your inheritance. Currently, twelve states have an estate tax, 5 have an inheritance tax, and one has both an estate and inheritance tax.

Capital Gains Tax on Inherited Property

What is the capital gains tax, and which states require it? The capital gains tax is paid on the appreciation of any assets that an heir inherits through an estate, but it is only levied once the asset is sold for a profit, not when you inherit. This tax is then paid on the difference between the sale price and the property’s purchase price. Most states require this tax to be paid on inherited property, but there may be exemptions for individuals selling a property for less than a certain amount. An example is Washington State, where the capital gains tax is not levied on homes and/or properties sold for less than $250,000. There may also be other legal ways to get around or reduce the capital gains tax in your state, including reinvesting the money in another property. Consult with a tax lawyer knowledgeable of the laws in the area you will be selling before proceeding with selling your property.

Estate Taxes

An estate tax is a tax paid directly out of the estate to the state before anyone is able to inherit it. Are you worried you might take a considerable hit from the estate? Don’t worry! The estate tax has a minimum threshold, which in 2023 was $12.92 million for individuals. This means that the government cannot charge you an estate tax unless your total taxable estate is worth $12,920,001. The remainder is passed on to the estate tax-free. Despite having such a high threshold, more states repeal their estate tax laws each year, losing millions of dollars of revenue.

Inheritance Taxes

Only six states have an inheritance tax, meaning that it is likely that you are in the lucky majority that won’t have to deal with this. But if you live in one of those six states – Maryland, Nebraska, Kentucky, New Jersey, Pennsylvania, and Iowa – you, as a beneficiary/Heir to an estate, will be required to pay taxes on your inherited assets and properties. But don’t worry – even if you live in a state with an inheritance tax, you won’t have to pay a dime if the deceased lived in one of the 44 states that do not have this tax.

Documents required to sell an inherited property

To show legal ownership and place a property for sale, you must have a copy of the documents issued by the court that grant you the legal authority to act as the executor or administrator of the estate. These documents will establish your ability to manage the inherited property. Once a buyer is found and you are ready to close, you’ll need the deed, title insurance, or other relevant legal records to establish the legal ownership of the inherited property.

Research what additional documents may be needed to sell an inherited property! Some jurisdictions may require additional property-related documents, including previous surveys, inspections, or any other relevant paperwork regarding the property’s condition or history.

Is there an easier way to sell?

Absolutely! Abbott Price is a trusted home-buying company that purchases inherited homes for cash. We focus on making the process easier and less costly for you. Contact us today for a solid cash offer on your inherited house, condo, or property. We buy homes in any condition and can assist you with the tricky steps of selling a house in probate! Our goal is to make selling your home simple and stress-free, allowing you to focus on what comes next in your life.

Even if your house was severely damaged in a recent storm, has been left without care for years, and requires many upgrades to sell, you can count on us! As soon as you accept our fair cash offer, our skilled team will take care of all those costly repairs for you. We strive to make selling your inherited home a breeze.

Contact Us today for your cash offer!

If you own a property that’s stuck in succession or probate that you are ready to sell, call us at (504) 655-6063 to get a competitive cash offer for that inherited home. We buy properties in any condition and no matter what the estate’s financial situation might be.